I had the good fortune to attend this weeks budget work session. Not much seems to have changed since the last budget meeting at which the Council voted to advertise a "not to exceed" tax rate of about $1.39. The current rate is $1.36. The higher advertised rate would allow the city to do some community investments and other stuff – those details are over in the budget dox on the city site and this post is not about that.

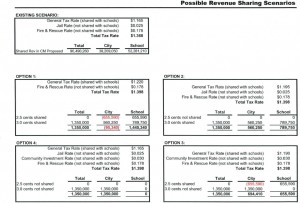

The conflict that started this hullabaloo was what to do about the "Jail Levy" that appeared in this years budget. The City Manager, at the last meeting distributed a "Sharing Scenarios" document. If you click on that graphic, you will see that things have suddenly become far more complicated. There is something called the "Community Investment Rate" that appears to be a new levy and, as such, is not shared with the schools. The Jail Levy is also in some of those scenarios – that is not shared with the schools. In addition there are options in most of the scenarios about sharing only 2.5 cents or 3 cents. It's quite the creation.

Click on me to see a bigger version

Look, I know that there are a lot of politics mixed up in here but this really is simple: honor the revenue sharing agreement and deal with the fallout in the budget. The schools are the city's partner, not our vendor (not to mention elected in their own rite). Forget about honoring the agreement – and then insisting on givebacks or anything else. Honor the agreement. Yes, the city will have to come up with some cuts and those won't be fun but at $100k-ish it shouldn't require closing the Museum or most of the other usual suspects. Hold a couple of positions open and budget the vacancy savings. Delay filling some new postilions. We did it when we passed the CIP, certainly it can happen again.

Yes the schools will get more money but that's the agreement we have. If you add the 3 cents into the rate the overall increase is about 7%. That's a lot but the things we're buying with that money are all things that our citizens have said they support. We heard a lot in the last election from Every. Last. Candidate. about how important Economic development, fixing roads and infrastructure in general are to our city. Those things aren't free and we need to have them in order to compete with the surrounding jurisdictions.

I'd note that PWC has passed a budget that includes money OVER AND ABOVE the revenue sharing agreement to help reduce class sizes.

If the Council and School Board can't seem to make these agreements work then they should agree to set a meeting outside the budget process and figure out what does work. I can see an argument both ways but no decisions can be made without facts. Put together a committee to study the agreement. Put those with the most financial acumen on that committee and get the budget folks to start generating some spending projections. Put some average increase in the budget, include some raises, a little bit of new construction, make some conservative tax assumptions and then inject those capital projects into the projections and see what shakes out. Maybe a workable structure comes from the effort, maybe it doesn't, but It's the only way to get it done. Trying to figure this out in the middle of the budget process just isn't going to work. Too many moving pieces and actual facts and professional projections are needed. Not "feelings" or straight up dogma. Facts.

April 23, 2015 at 12:11 pm

Certain powers that be forget that quality schools are one of the three building blocks of local economy.

April 23, 2015 at 3:14 pm

Perhaps the school board should require of the burgeoning school administration to "Hold a couple of positions open and budget the vacancy savings. Delay filling some (old &)new positions."? The truth is that an abundance of dollars spent per Chief, leaves too few nickles for the Indians(teachers & front line staff). Those same tax revenue dollars invested into important line items such as; Economic development, fixing roads and infrastructure in general are far more beneficial to our city. IMHO

April 23, 2015 at 6:46 pm

Agree with Andy. An agreement is an agreement is an agreement. One must stick to one's word. Certainly all can agree on that without resorting to smoke and mirror explanations. Beware of losing (all) credibility.

April 23, 2015 at 10:48 pm

Jon, it's not the schools that have a $1 million gap in our operating budget. It's not the schools that have been funding an on-going annual charge for jail operations as if it were a one-time expense. The schools have a balanced budget. Your comments about "burgeoning school administration" are so off-base as to be laughable. When compared to surrounding school districts, we come out doing more with far fewer administrative positions. And your comments about dollars for chiefs and "nickles for the Indians" are an insult to a superintendent who has our schools headed in a positive, planned direction. Part of that plan depends upon the city to honor its signed agreement to provide a specific amount of revenue to the schools each year. A levy is a way to exempt dollars from that agreement when they were originally included in the plan. Honor the commitment. Don't use our children as a funding source. We are partners in working for the best for the city. But our word needs to mean something. Our agreements need to matter all the time, not just when it is convenient.

April 24, 2015 at 7:04 am

Well said, Mr. Bushnell. It's interesting to me that when money gets tight the first two things on the chopping block are school funding and the Museum. Strong schools are what will attract residents and our history is what draws visitors. They should be supported. If Council would like to revisit the revenue sharing agreement that's fine, but not in the middle of the planning process.

April 24, 2015 at 7:32 am

Every election brings brings briefly renewed interest in economic development and schools but after the election signs fade we're back to the same old same old: abortion and budget.

April 24, 2015 at 8:49 am

I know I'm probably in the minority here, and expect to get blasted as anti tax, school hater or generally a mean cheapskate.

From 2007-13 our taxes increased 63% (WaPo 3-14-14 by Tom Jackman) Highest increase in NOVA

Last year 10%, for me that was only approx.$35-40 monthly.

Another 7.2% needed this year, for me approx. $30 a month.

Will it ever be enough?

These increases far out pace inflation and wage increases.

I have said this before, I feel like a bottomless piggybank for the City

April 24, 2015 at 8:54 am

If it looks like a duck, walks like a duck and quacks like a duck……..it ain't a levy, it is a tax.

April 24, 2015 at 8:54 am

Bud – I don't think you're a mean cheapskate, everyone's entitled to their opinion. The only thing I'd point out is that Tom Jackman's analysis is really bad. At the end of the day, I, like you, am most concerned with what I'm going to pay. Jackman's "analysis" only looks at how much the tax RATE has changed and does nothing to consider assesments. The rate is only one part of the calculation. Only using the rate is pretty lame and misleading.

April 24, 2015 at 9:43 am

The down hill slide for us began a few years back when they "fixed" the grading scale, lowering the standard under the guise the students couldn't compete for college. We moved to a private school system that used the tougher grading scale and those kids don't have a problem getting accepted to Tech and Ivy League schools. We eventually left the city. Didn't think the schools were as good as they used to be and couldn't see paying higher tax dollars on top of tuition.

April 24, 2015 at 12:12 pm

A simple word problem:

Yes assessments count. Word problem of the day.

Mary owns a house in PWC with a high assessed value and a low tax rate and pays 5k in property tax. James owns a house in MC with a low assessed vaue and a high tax rate and pays 5k in property tax.

Who's property is the better financial investment? The answer is Mary and MC is at risk of losing James as a resident.

April 25, 2015 at 8:01 am

Carolyn, you have accurately articulated the equation. That's great but the real question is what to do about it? What level of tax reduction turns that investment into a good one? 10-20% ? Will tax reduction transform people's perception of value? What happens to the schools and city services when we cut the budget? Are residents that live in this area looking for bare minimum services and lousy infrastructure? It doesn't seem so…..

April 25, 2015 at 9:48 am

More levies for this or that, when will it end? I agree with Andy, there is an agreement so stick to it. This smoke and mirrors being played to exempt this or that expenditure is contrary to the good faith that went into the agreement in the first place. Heck, I don't personally like the agreement but it is what it is and our budget process needs to deal with reality without violating the intent. if there is real need to revise (or dump for some other plan) then do so without a budget deadline forcing extraordinary measures.

There are plenty of cities in Virginia that all fund the same things we have to fund, let's find out what is working elsewhere and figure out how to apply that here. But live up to the agreement until there is something officially different in place.

April 28, 2015 at 9:13 am

It is Virginia law that properties are to be assessed at 100% of their retain value, it also appears that the City of Manassas always appears at the top of the list as one of the municipalities being the most compliant with this law. Former Commissioner of Revenue John Grezeka had mentioned that in years past there were times where the City was 105%-110% above market value and when he started lowering the property values to simply 100%, the rates increased. When one compares the assessments of localities particularly to the south and west, one will find the assessments no where near the 100%. At the end of the day, no matter which part of the equation you adjust, it all boils down to is how large of a check must I write to the City of Manassas for the privilege of living in the City and is that privilege worth it.